Newgen’s Electronic Documents Record Management System (EDRMS) enables end-to-end management of enterprise records, from creation, maintenance, and usage to disposition. It helps improve accountability of physical and electronic records by maintaining their authenticity, reliability, and integrity. By leveraging the system, enterprises can excel audits and meet compliance goals for legal and regulatory requirements such as DoD 5015.02, VERS, ISO 16175 1 & 2, ISO 15489, and NRAA Oman.

What to Look for in an Ideal Electronic Documents Record Management System (EDRMS)?

Newgen’s Electronic Documents Record Management System (EDRMS) enables end-to-end management of enterprise records, from creation, maintenance, and usage to disposition. It helps improve accountability of physical and electronic records by maintaining their authenticity, reliability, and integrity. By leveraging the system, enterprises can excel audits and meet compliance goals for legal and regulatory requirements such as DoD 5015.02, VERS, ISO 16175 1 & 2, ISO 15489, NRAA Oman and NRAA Singapore.

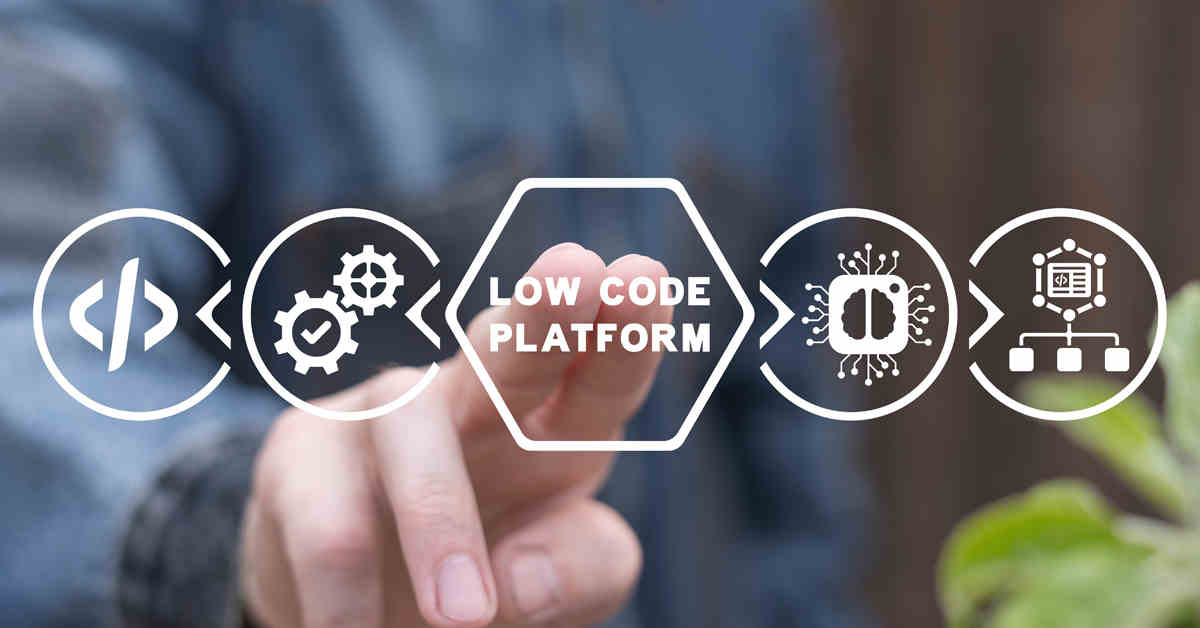

A Platform-based Approach

To keep up with dynamic business requirements, you must invest in a platform-based solution that is agile, future-ready, and has key capabilities, including artificial intelligence (AI)-and machine learning (ML)-based content classification, metadata generation, mobile-based access, and social content management

Adherence to Security and Compliance Measures

The system must ensure the authenticity, confidentiality, and integrity of records with comprehensive security capabilities. Furthermore, the system must comply with global standards and system certifications, including DoD 5015.02, ISO 15489, ISO 16175, VERS, NRAA Oman and NRAA Singapore

Advanced Technologies for Intelligent Automation

The solution must automate the end-to-end records lifecycle, from creation to disposition. Additionally, the chosen solution must be powered with new-age technologies, such as AI, ML, and robotic process automation, etc.

Collaboration Using Productivity Applications

While evaluating a solution, consider its ability to leverage AI and GenAI to enhance employee productivity and easily align with organizational needs. AI-powered automation accelerates workflows, while GenAI-driven insights enable smart recommendations and intelligent content discovery. This empowers users with the right tools to collaborate across geographies, access critical information instantly, and share documents effortlessly.

Federation Across Multiple Systems

An ideal records management software must offer a unified view of information, while enabling your users to access, edit, and manage documents through productivity-focused applications like Microsoft SharePoint. Additionally, the solution should feature federated search capabilities, to search connected repositories and content management systems, from a single interface

Integration with Enterprise Apps

Your selected records management software s should integrate with other business applications, tools, repositories, and cloud storage systems through APIs and web services, ready-made adaptors, integration standards, and custom APIs. Additionally, it must support microservices and containerization-based deployments

Smooth Migration from Legacy Systems

The chosen records management solution must seamlessly adapt to your organization’s growth, evolving business needs, and future requirements. Furthermore, the solution must enable seamless migration and modernization of legacy systems and offer interoperability for efficiently delivering civic services

How Does Newgen Solve Your Electronic Documents Record Management System (EDRMS) Needs?

Hybrid Records Management

Manage the complete lifecycle of various types of records, including e-mails, physical, and electronic records while retaining their integrity and authenticity. Create and manage various classification schemes for records that help in easy search and retrieval

Intelligent Records Classification

Enable rapid digitization of physical content through scanning and intelligent information extraction. Leverage the power of AI and ML to classify records based on content for smarter classifications and metadata generation

Governance and Compliance

Ensure complete governance of data for compliance and regulations. Create labels and policies, such as retention, disposition, and storage to keep records complied to various regulatory standards

Seamless Collaboration with Productivity Applications

Manage records with a range of systems and facilitate real-time collaboration using business productivity apps, such as Microsoft Outlook, Microsoft Office 365, MS Teams, SharePoint, Google Docs, and more

Customers