Ensure your organization’s compliance with various regulatory and internal requirements by leveraging our industry-specific, platform-based solutions. Automate your end-to-end compliance and reporting processes to increase visibility, guarantee data security, bridge operational silos, and stay future-ready.

Features of Financial Compliance & Reporting Software

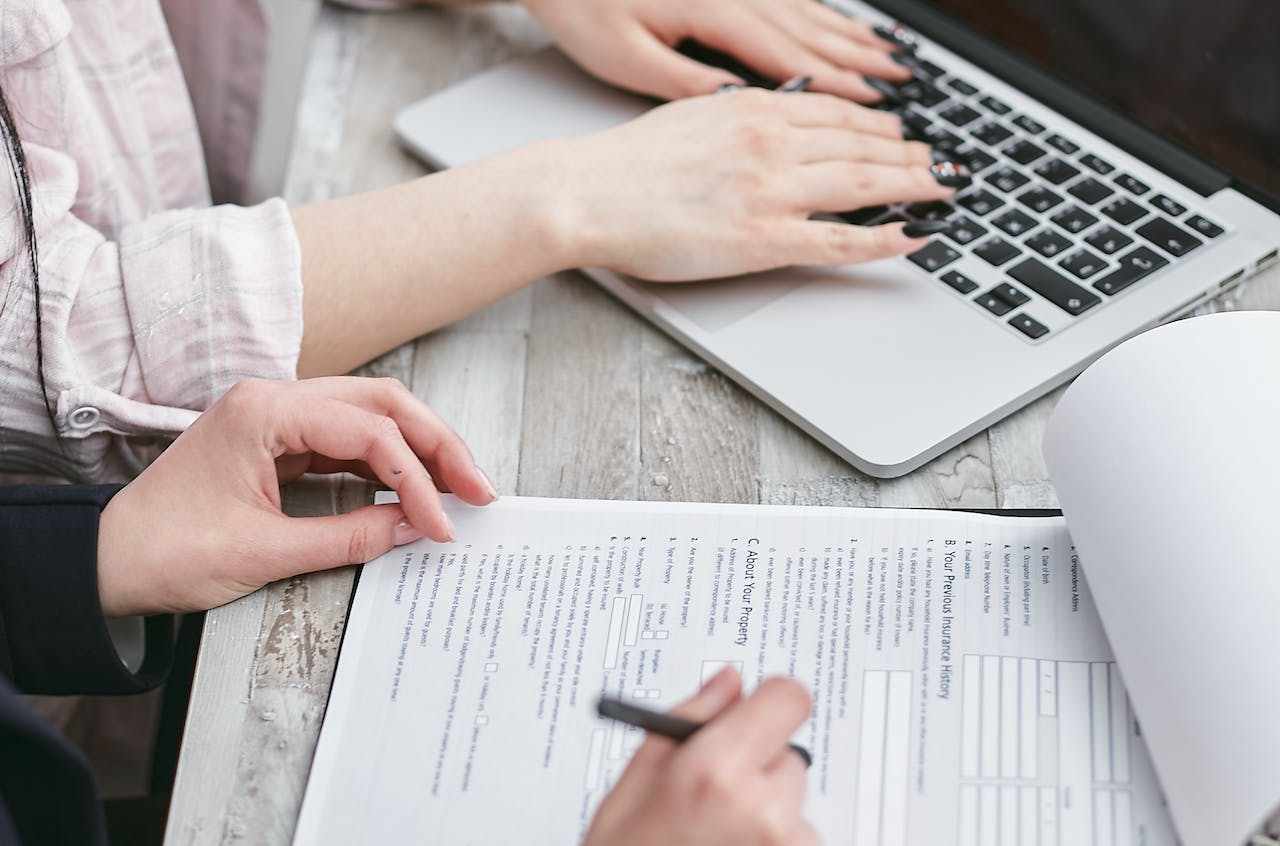

Wealth Management Reporting

Automate end-to-end reporting process. Cover Every aspect of client reporting, including data aggregation, validation, creation of personalized reports, multi-channel distribution, and archival. Monitor process performance, rule-defined approvals, and customer communications with controlled process, and KPI-based allocations and activity dashboards. Drive better departmental coordination, communication, and information handling with an interconnected account opening workflow.

FATCA Compliance

Get end-to-end compliance, from initiation to classification, remediation, decision making, and archival. Classify and maintain documents, along with reporting of Know Your Customer (KYC) details required for FATCA activities. Automate due diligence processes, enabling relationship managers to handle multiple complex customer relationships. Ensure smooth execution of FATCA KYC activities on top of existing core banking systems and get better visibility, control, and data security.

Common Reporting Standard

Get a step-by-step, comprehensive compliance strategy. Ensure compliance, stay future-ready, and engage customers with a configurable framework. Access the combined power of our BPM, case management, ECM, and CCM software.

Customers