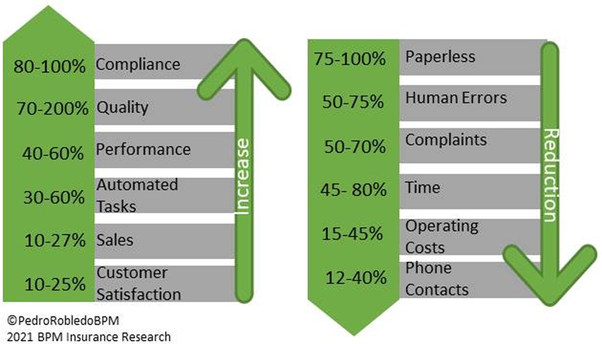

Streamlining business processes while maintaining efficiency provides a crucial competitive advantage for enterprises. Across industries, including insurance, businesses have turned to business process management (BPM) software to overhaul core processes. As insurance operations have grown in size and complexity, processes have become fragmented, with users navigating multiple applications, leading to inefficiencies in tracking and management. However, the right BPM software has the potential to reorganize and enhance critical insurance processes. Before diving in, it’s essential to identify which insurance processes are best suited for BPM implementation.

Discover the top 3 use cases where business process management software can bring efficiencies:

Business process management platform is a powerful tool that transforms insurance operations by automating workflows, streamlining processes, and enhancing overall efficiency. Let’s delve into how a BPM platform can transform three critical areas of insurance operations: underwriting, policy administration and servicing, and claims management.

Underwriting

Underwriting is a crucial process for every insurance provider. By using a business process management (BPM) software-based underwriting engine, insurers can streamline the traditional manual processes involved in data collection, risk assessment, and decision-making. The software automates critical underwriting tasks, such as data entry and verification, which accelerates the underwriting process while minimizing errors. This, in turn, leads to faster decision-making, improved accuracy, and enhanced compliance through adherence to predefined rules and policies.

Policy Administration and Servicing

The dynamic market and regulatory changes are pushing insurance firms to shift their focus on improving policy administration and servicing. Insurers are often challenged with siloed systems, manual handling of tasks, absence of quality checks, ineffective customer communication, and lack of service level agreement tracking. With the right BPM platform, insurance firms can orchestrate and model the end-to-end policy servicing process. They can undertake parallel processing of complex cases, ensure straight-through processing of simple requests, easily handle all types of financial and non-financial policy transactions, comply with regulations, and more. This results in enhanced customer experience through faster turnaround time and reduced errors due to improved data accuracy.

Claims Management

Insurance providers need to sustain a balance between fast and accurate claims processing, a critical function to maintain a high level of customer satisfaction. A claims management software built on a BPM framework can enable insurers to proactively manage the lifecycle of a claim and automate the end-to-end claims workflow. From initial notification to final settlement, the business process management platform facilitates efficient communication and collaboration among stakeholders. This leads to faster claim processing, improved fraud detection capabilities through integration with analytics tools, and enhanced visibility and control over claim workflows. Insurance firms can also benefit from the in-built business rule management engine to oversee various policy breach conditions.

Insurers need to stay ahead of their competition by optimizing their processes, and the right business process management software can help significantly. However, selecting the right BPM software can be a challenge as insurance providers need to understand the must-have capabilities of the software to maximize the benefits. To better understand what BPM can do for your insurance company, read this case study on how a Philippines-based insurance firm integrated BPM to create an automated enterprise, improve customer experience, improve process visibility, and ensure straight-through processing.

You might be interested in

22 Jan, 2026

Why storing everything is not the optimal email archiving strategy for 2026