Automate and centralize standard trade finance processes, including export and import-related documentation, negotiation, quotation, and remittances. Ensure adherence to SLAs and regulatory requirements by implementing checklists, efficient tracking of credit documents, and internal controls. Furthermore, increase the scale of operations by extending trade finance services to even low-volume branches.

SWIFT-Compatible Trade Finance Solution

Message creation and processing

Message flow control

Message reconciliation

Message repair and STP enrichment

Message validation (syntax, XML Schema)

Message validation (market practices)

Message transaction management

Message technical or business activity monitoring (BAM)

Message exception handling

Message switching and routing

Message reporting and auditing

Message validation (SWIFT Network rules or MFVR)

Message translation (MT-MX)

Message entry (Graphical User Interface)

Features of Trade Finance Automation Solution

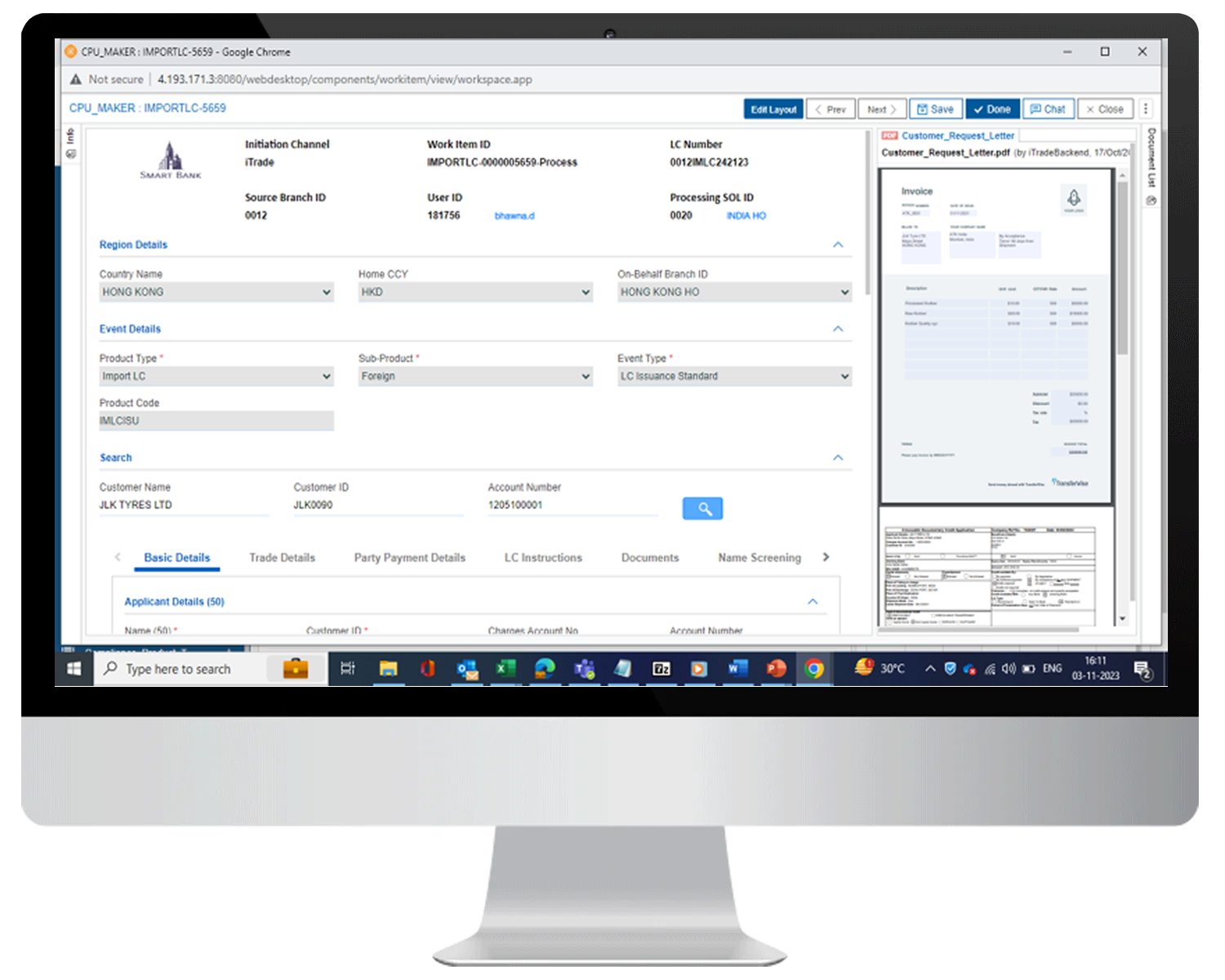

Multi-channel Trade Process Initiation

Ensure multi-channel transaction initiation via web portal, handheld device, or branch walk-in. Monitor business activity to track loan requests, processes, and resource utilization, as well as generate reports and user-specific dashboards.

Trade Process Monitoring and Reporting

Centralize trade operations with online trade finance processing at a central hub. Improve liquidity with the release of cash otherwise stuck in a complex supply chain. Master data management module to manage various masters. Eliminate manual case reviews with an automated rules engine.

Loan Limit Availability Check

Limit availability checking to fetch and earmark limits and push the limit utilization data for each transaction. Instant access to loan account numbers and repayment schedules. Get automatic retrieval and population of customer details from core banking system. Post transactions directly into the core banking system.

Financial Institutions using NewgenONE Platform

NewgenONE Success Stories in Financial Institutions

Newgen Solutions for Transaction Banking

All you need to know about Trade Finance Automation Software

Newgen software provides a complete unified solution for Trade Finance which includes end-to-end trade finance processing, supply chain finance, payments hub, and compliance.

The various products included in Newgen’s Trade Finance solution are:

- Letter of credit

- Standby letter of credit

- Bank guarantee

- Bills under the letter of credit

- Bill under collection

- Outward remittance

- Inward remittance

- Import and export financing

- and more

Yes, Newgen offers OCR technology for auto-updating of fields on the forms. Apart from the OCR technology, Newgen also offers classifying, extracting, and validation of documents using AI / ML-based models for identifying and populating discrepancies in line with UCP / ISBP / URC, etc.

Yes, Newgen offers a customer web portal that is interactive and supports two-way communication. All transactions between the bank and the customer can be initiated through the web portal.

Yes, Newgen offers digitization of documents, as part of the automation process of its Trade Finance Solution. Newgen’s Trade Finance Solution is tightly coupled with a document management system where documents are digitized as well as archived.

Yes, Newgen’s Trade Finance solution has built-in international compliance which come with the solution as out of the box. However, concerning sanction screening, the Newgen trade finance solution will integrate with the existing screening system of the bank via integration adapters. APIs for integration will be shared by the bank at the time of gap analysis.

Yes, the solution can process end-to-end payments including cross-border and local payments. Newgen product is also SWIFT, and GPI compliant and supports ISO 20022 compliance as well.

Yes, end-to-end processing of supply chain finance is supported. The products under the module include marketplace, pre-shipment finance, post-shipment finance, factoring, reverse factoring, Forfeiting, and more.