The Digital Transformation Journey

The financial services industry has rapidly transitioned– and how! From manual and paper intensive to AI-led automated processes, this industry has fully embraced digital transformation. In fact, according to a leading tech giant, financial services has the second highest adoption rate of AI across industries.

Banking, a key sub-vertical of this industry, has a solid track record of spending on emerging tech, especially AI. Technological advances have fueled the banking operations by fourfold. Processes that were once labor-intensive and tedious have been revolutionized with the emergence of the internet and mobile banking. Automation and AI have brought a sigh of relief from the plight of repetitive and monotonous tasks- whether it’s processing loan applications, or managing thousands of supplier invoices- allowing businesses to focus on innovation and strategy.

But is AI new to Banking? Not at all. “Traditional AI” has existed in the Banking world since years, but with limited adaptability. Consider this scenario- Harry visits a banking website and interacts with its chatbot, looking for a tailored investment product. However, the chatbot reliant on pre-fed data suggests generic options- or worse, fails to offer any relevant suggestion. Intelligent, yet incomplete. While AI has been around for years- its capabilities have been limited to predefined rules, giving rise to the need for autonomous and contextual AI, that takes decisions as well.

That is where Agentic AI steps in.

Enter Agentic AI

Unlike GenAI, which is reliant on prompts, Agentic AI acts autonomously to solve novel problems in real-time. It doesn’t just simply respond– It thinks, analyses, and acts contextually. Gone is the one-size-fits-all approach; it rather leverages real-time customer data like transactional history, risk appetite, and investment style, and suggests relevant investment products.

The intelligent system deploys specialized agents that break down complex problems into simpler components, solve them independently, producing an optimal result. These agents work smartly in tandem imitating a human’s decision-making capabilities. Impressive, isn’t it? Maybe imitation truly is the sincerest form of flattery here!

Today, Harry would not leave the website disappointed but with customized investment products based on his risk appetite, past transactions, and investment style.

With the second highest adoption rate, the Financial Services industry has welcomed agentic AI with open arms, with a profound impact on banking operations. From customer onboarding to highly personalized recommendations to fraud detection and even managing credit and financing risks in supply chains– AI agents are being envisioned to revolutionize every corner of banking. Let us explore some of the most impactful use cases.

Agentic AI Use Cases in Banking

- KYC and Onboarding

KYC (Know Your Customer) is a crucial process for Banking. It involves verification of the client aiming to prevent fraud. AI Agents are fueling the KYC process by analyzing large volumes of data and identifying any anomalies or potential risks, hence streamlining onboarding processes without any human intervention. A well-defined multiagent system manages critical tasks like document verification, risk assessment, and onboarding.

- Hyperpersonalized Recommendations

Personalized recommendations are a ‘must have!’ in today’s hyperpersonalized era. In fact, as per research by a top CRM organization, more than 60% of banking customers expect personalized recommendations. Harry, with low-risk appetite, wouldn’t be happy if he is suggested a high-risk investment product. To each his own! AI Agents play a crucial role here. They analyze transaction histories, spending patterners, behavioral and demographics data and financial goals, offering bespoke recommendations. This will significantly result in increased customer satisfaction and improve retention rates.

- Credit Risk Assessment in SCF (Supply Chain Finance)

In supply chain finance, trust is currency. But how do banks and buyers assess the creditworthiness of thousands of suppliers in real time? Here’s where agentic AI steps in. Smart agents work behind the scenes to assess supplier risk in real time. They review financial statements, tracks payment behaviors, and even scan news for red flags. If a supplier shows signs of trouble – late payments, bad press – the agent already flagged it and recommended action. With these proactive agents on the job, banks can make smarter, faster financing decisions – no spreadsheets, no guesswork.

- Loan Approvals

According to a market and industry research firm, AI’s penetration in the lending market is poised to reach to around $58 billion by 2033 at a soaring 24%, with high adoption of AI being the major driver. The introduction of AI Agents to the world of loan processing opens new doors for innovation. AI Agents streamline critical tasks like document handling, risk assessment, customer service automation, and regulatory compliance management. Agentic AI simplifies real-time decision-making by analyzing a borrower’s digital footprint and spending habits, leveraging its capabilities of analyzing massive volumes of data.

- Fraud detection and prevention – with smarter Supply Chain Finance

Frauds, frauds everywhere! As per a leading market research firm, the fraud detection and prevention markets are poised to grow to $63.2 billion by 2029 at a whopping CAGR of 17%, with North America leading the charge. The rapid surge in digital transactions has exposed financial institutions to new vulnerabilities, especially in high-volume areas like supply chain finance – driving a need for the agentic AI framework. What role will the agents play here? These smart agents continuously scan historical and real-time data to flag suspicious patterns – duplicate invoices, unauthorized requests, unusual transaction spikes. Working alongside Newgen’s anti-fraud features like dedupe checks, real-time credit limit management, and digital signature-based approvals, they detect and stop fraud before it happens.

The result? A fraud defense system that’s not just reactive—but proactive, predictive, and always alert.

This is not an exhaustive list of use cases. Agentic AI is capable of much more! Let’s explore the key benefits it brings to the industry.

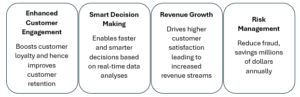

Benefits of Agentic AI for Banks

Final Thoughts

Agentic AI has brought extraordinary capabilities to the banking operations making real-time decisions simpler yet smarter. With an immense potential and a promising future, Agentic AI does leave us with some questions – Does the emergence of Agentic AI in the banking sector signal the end of human-in-the-loop? Have we transitioned from a DIY (Do IT Yourself) approach to a completely DIFM (Do It for Me) era of disruption?

Agentic AI is already reshaping the future of banking – and here to stay!

You might be interested in

22 Jan, 2026

Why storing everything is not the optimal email archiving strategy for 2026