Overview

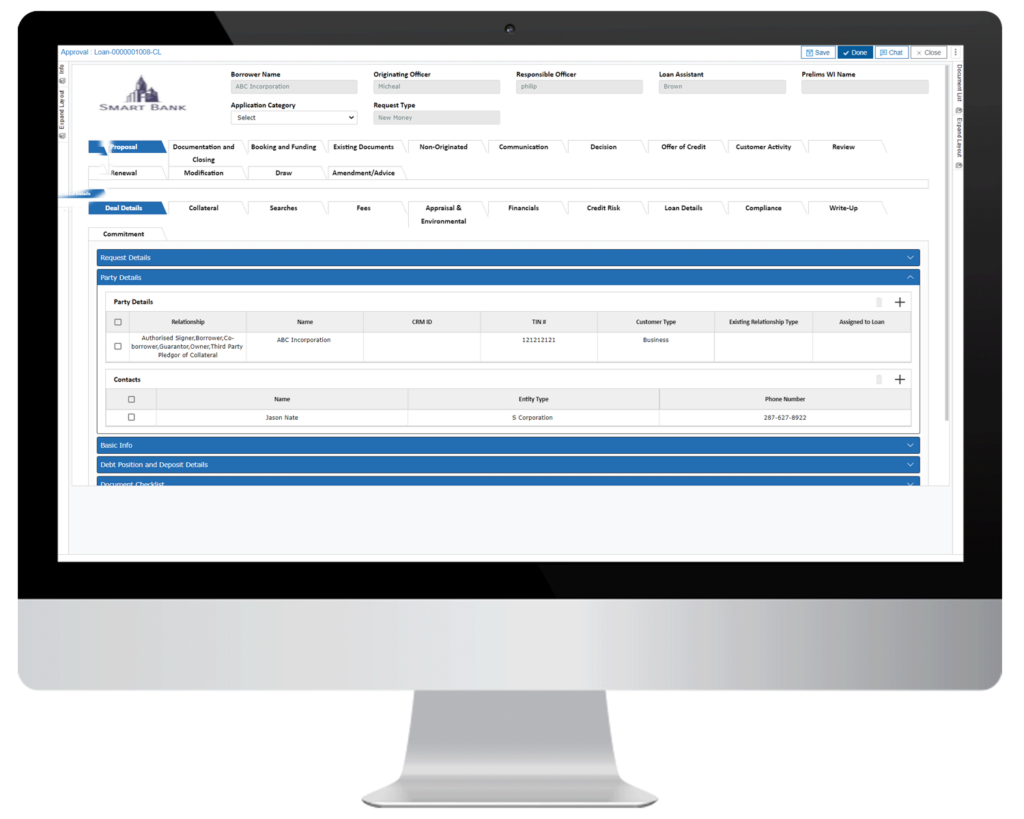

Utilize a user-friendly interface to automate the lifecycle of your small and medium enterprise (SME) loans. Simplify your SME onboarding and lending processes from start to finish within a digital setting. Effortlessly integrate with legacy systems and third-party applications to optimize current investments and ensure future adaptability, scalability, and effectiveness.

Key Features

- Prospecting and Lead Generation- Efficient lead management and handling of cross and upsell opportunities

Simplified Onboarding – Seamless onboarding with several configurable templates for customer and product specific data capture - Credit Analysis and Underwriting- Comprehensive credit assessment tools that take into account financial information, ratio analysis, account conduct and pricing

- 360 Risk Management- Complete due diligence through peer group analysis, trade checks, real-time pipeline view, automated rules & standardized processes

- Collateral Management- Unified workflow around releasing, updating, valuing and moving collaterals and other linked processes

- Collections and Provisioning- Efficient management of delinquent accounts and linked accounts through incessant follow-ups and history logs

- Servicing and Restructuring- Effective asset management, branch/trade referrals, partial settlements, credit extensions and foreclosures