The holy grail of an insurance business is the ability to process claims efficiently and accurately. In this customer experience era, reaching that ‘Promised Land’ of customer loyalty and customer delight for insurers, like you, ultimately boils down to how swiftly and accurately you achieve claims settlement.

To reach there, you must bid adieu to the conventional ways of processing claims, diligently approach the overall process, and find the right technology for your claims management software. And, finding an ideal claims management software for your organization demands careful consideration and evaluation. In order to streamline this process and ensure that you select the most suitable claims management services and portal, it’s essential to delve into nine key factors that play a crucial role in determining the efficacy and compatibility of the claims management software with your organization’s needs.

1. End-to-end Automation Capability

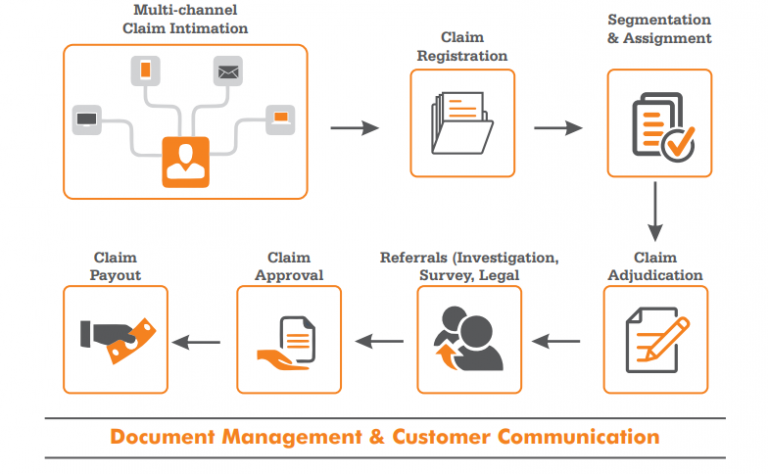

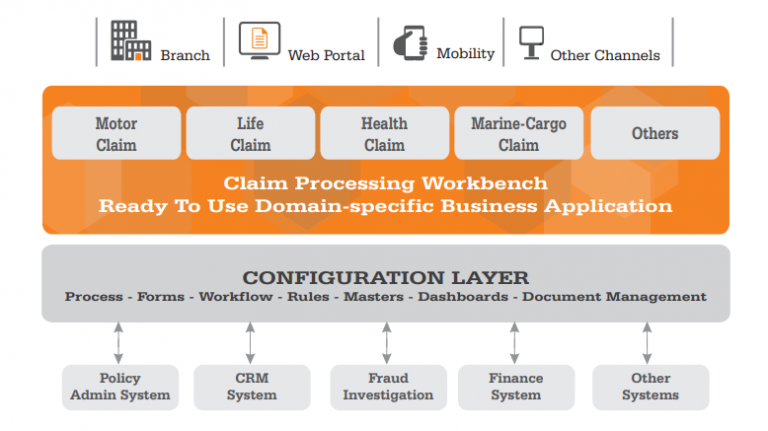

You should look for a low code-based software that facilitates integration with new-age technologies, including analytics, artificial intelligence (AI), machine learning (ML) , and robotic process automation (RPA) to automate the end-to-end journey of insurance claims. Leveraging AI/ML and RPA-enabled claims management software can help you automate the most mundane yet complex claims processes, from receiving an application request through any channel, assigning it to the claims admin, routing, case adjudicators, to the final settlement.

2. Document Digitization and Multi-channel Support

You must seek a claims management automation software with content management capability that can help you efficiently manage a high influx of claims documents. The claims management software must facilitate the initiation of content from multiple channels, including physical, e-mail, website, social, etc. Furthermore, for the easy access and retrieval of the policy details by the user, the content must be available on a centralized repository.

3. Smart Case Routing and Allocation Mechanism

Your insurance claims management platform must have rule-based algorithms that allows you to automatically categorize claims as “fast track” or “non-fast track.” Additionally, the claims automation software should be able to auto-prioritize cases at different queues and work steps and, depending on the rules, automatically route claims based on the adjudicator’s workload and prior experience in handling complex cases.

4. Provides customer self-service portal

Your customers must have the flexibility to submit claims in real-time and track their progress at each stage of the process. Thus, a claims management portal should support a customer self-service portal that can be accessed via a mobile and web-enabled application.

5. Comprehensive Claims Assessment Tools

The claims management platform should be able to do a complete evaluation of each claim by giving the assessor an all-inclusive dashboard. It should be able to auto-identify claim type based on policy data and auto-assess claim details against the stated plan and coverage details, claimant details, and other system check outputs. Furthermore, the claims management platform should have an option to define alternative rule sets for auto-calculating the authorized amount and co-payment based on claim submission parameters.

6. Insights and Monitoring Capabilities

The ability of claims automation platform software to actively monitor cases and give detailed insights to ensure tight adherence to turnaround times (TATs) and service level agreements (SLAs) is one of its most critical qualities. Therefore, the claims management tools should define key performance indicators (KPIs) to monitor and measure user efficiency, an escalation matrix and monitoring reports to ensure transparent, and timely claims processing, payments tracking, user productivity and workload reports, raise fraud alerts in the event of discrepancies, and more

7. Customer Communication Support

Timely communication with customers is important so that the knowledge workers are aware of the status of their claims at any stage. Furthermore, at any relevant stage of the business, the claims management portal must enable users to auto-trigger communications to customers, third-parties, agents, distributors, and relevant employees via texts or emails. This includes generation of letters of guarantee, case summaries, settlement letters, and more.

8. Robust Integration Architecture

An ideal claims management solution should seamlessly connect with existing systems and databases, such as the core PAS system, accounting system, mobile app, e-mail and SMS gateways, and CRM. This allows you to make the most of your existing technology investments while also providing smooth information flow throughout the claims department.

9. Seamless Collaboration Between Stakeholders

The claims management automation software makes it easier for all the involved stakeholders to minimize the processing cycle times. The claims assessor should be able to simultaneously refer the case to different internal/external teams for assessment and comment. The concurrent execution of various operations on the case speeds up the processing cycle. The assessor can then quickly determine whether to approve, refuse, close, mark as pending, or forward the case to other teams within the claims platform.

The Final Word

All these aforementioned considerations will help you select the right claims management solution for streamlining end-to-end claims processing cycle. In terms of functionality, you must invest in a comprehensive claims management platform with an automated workflow-based claims process that allows your documents and data to move in tandem, offers enterprise-wide visibility and reporting, and enhances seamless collaboration among stakeholders.

You might be interested in

22 Jan, 2026

Why storing everything is not the optimal email archiving strategy for 2026