370 % ROI

Achieved by Newgen customers

Enhance Customer Experience

by personalizing each interaction and automating the entire customer journey

15 Billion

Documents digitized in a single deployment

Automate End-to-End at Scale

by automating enterprise-wide applications while empowering a hybrid workforce

25 Patents

Powering a high performance platform

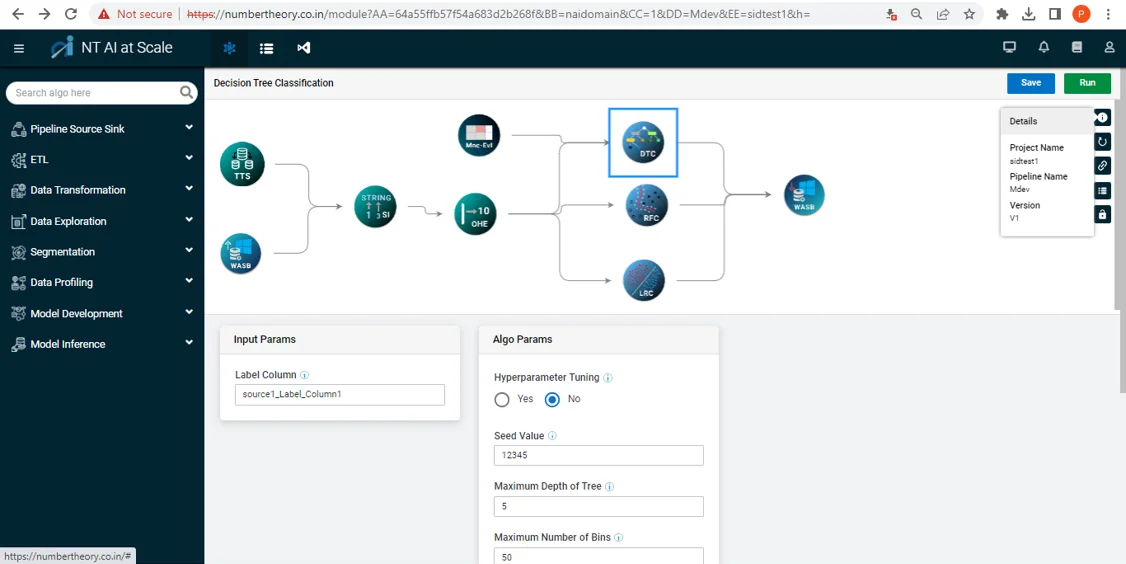

Innovate Continuously with Intelligence

by leveraging insights to optimize decisions and processes and discover new opportunities

370 % ROI

Achieved by Newgen customers

Enhance Customer Experience

by personalizing each interaction and automating the entire customer journey

15 Billion

Documents digitized in a single deployment

Automate End-to-End at Scale

by automating enterprise-wide applications while empowering a hybrid workforce

25 Patents

Powering a high performance platform

Innovate Continuously with Intelligence

by leveraging insights to optimize decisions and processes and discover new opportunities

Join Leading Global Brands

Join Leading Global Brands

Join Leading Global Brands

Join Leading Global Brands

Join Leading Global Brands

Join Leading Global Brands

Join Leading Global Brands

Join Leading Global Brands

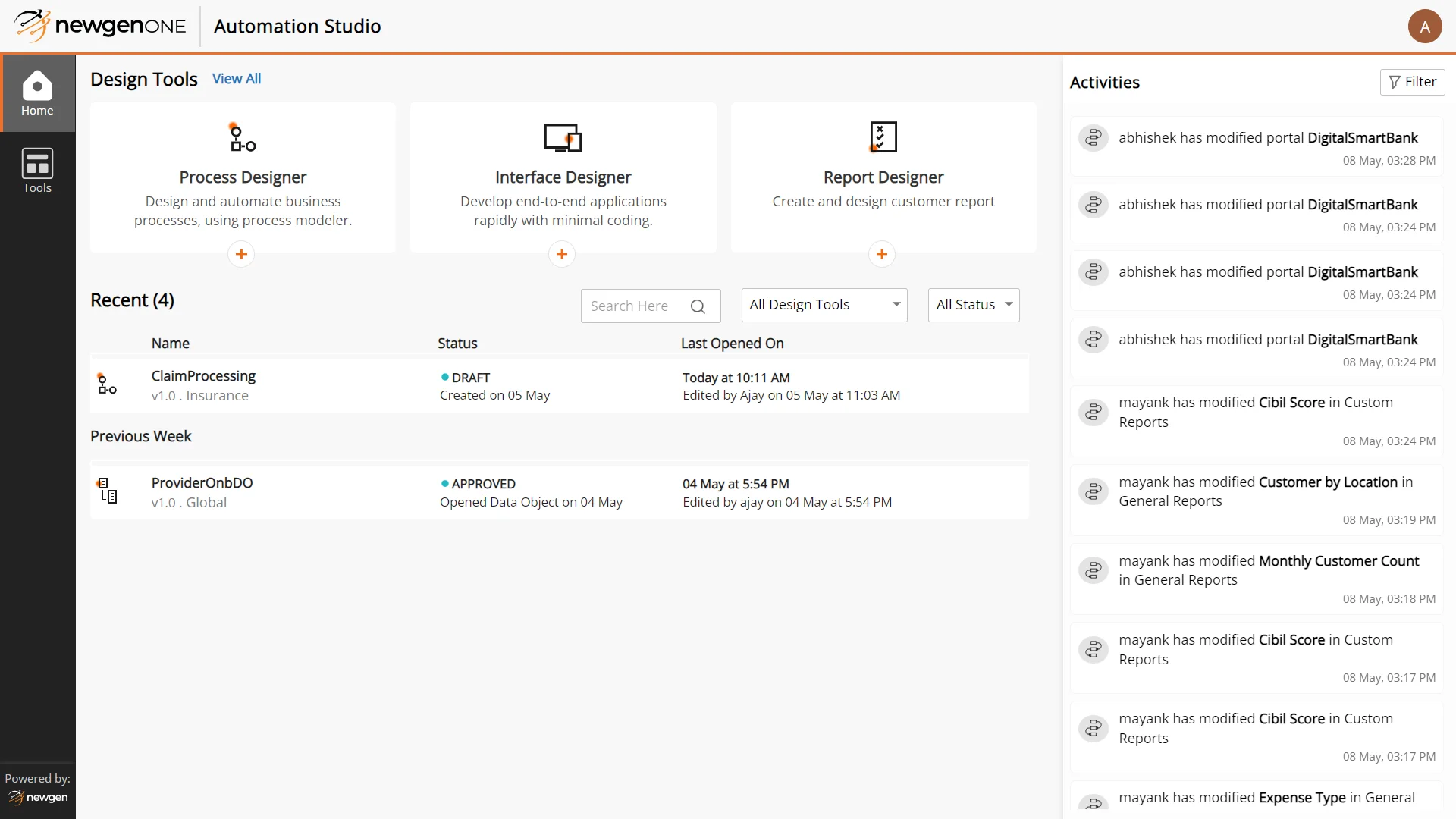

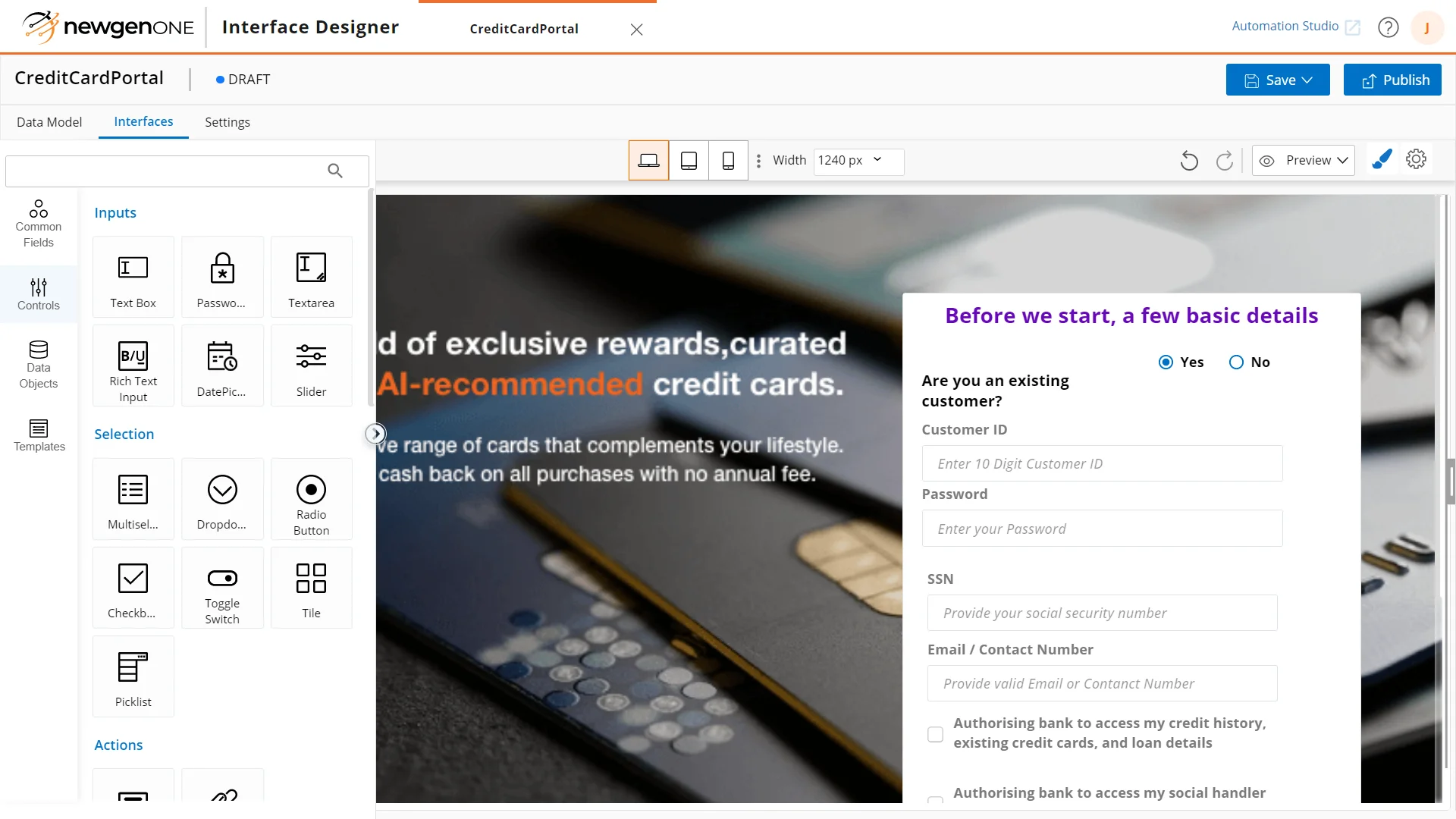

Discover NewgenONE Capabilities

Low code platform for end-to-end automation at scale

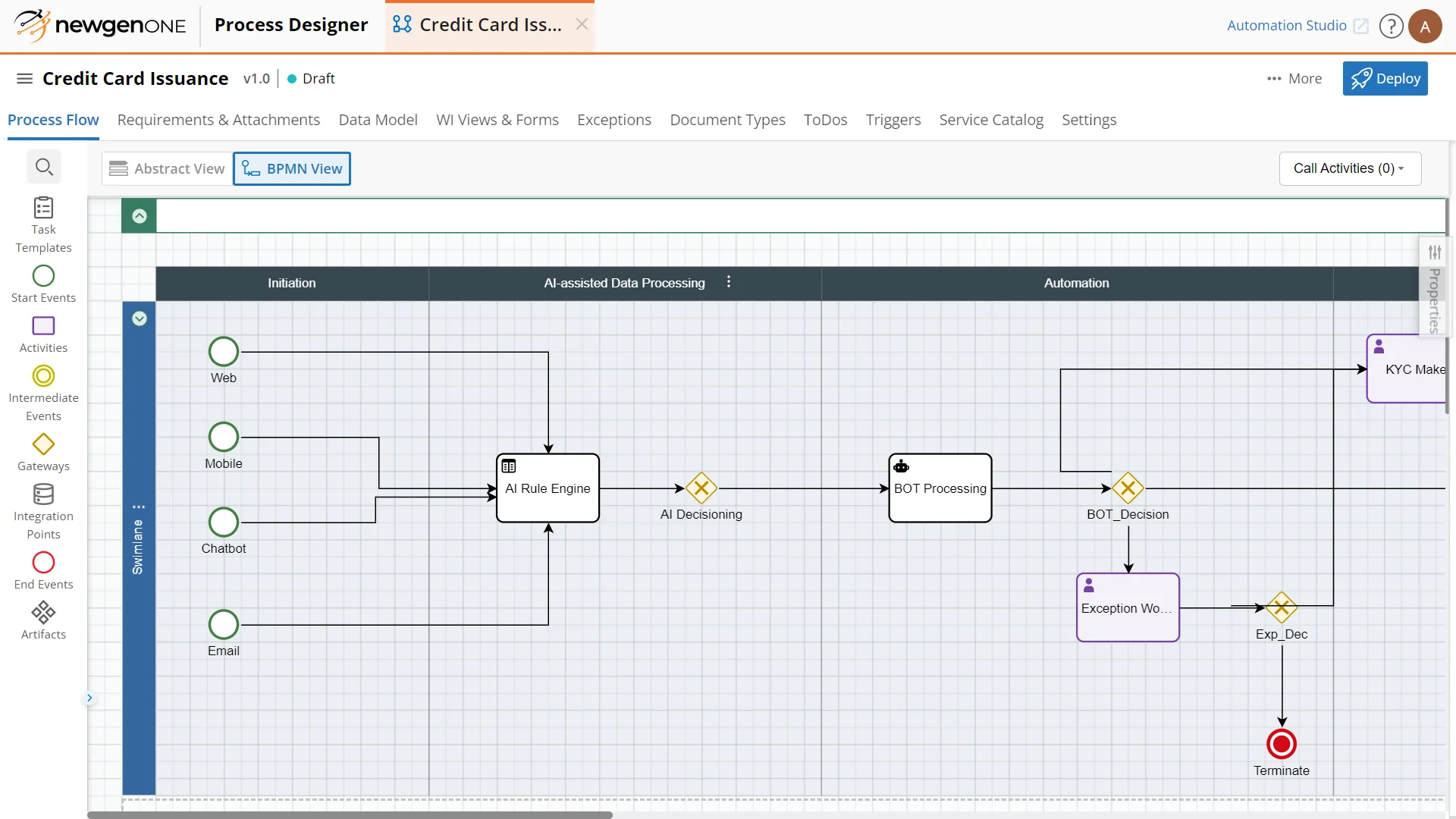

Rapidly automate end-to-end customer journeys

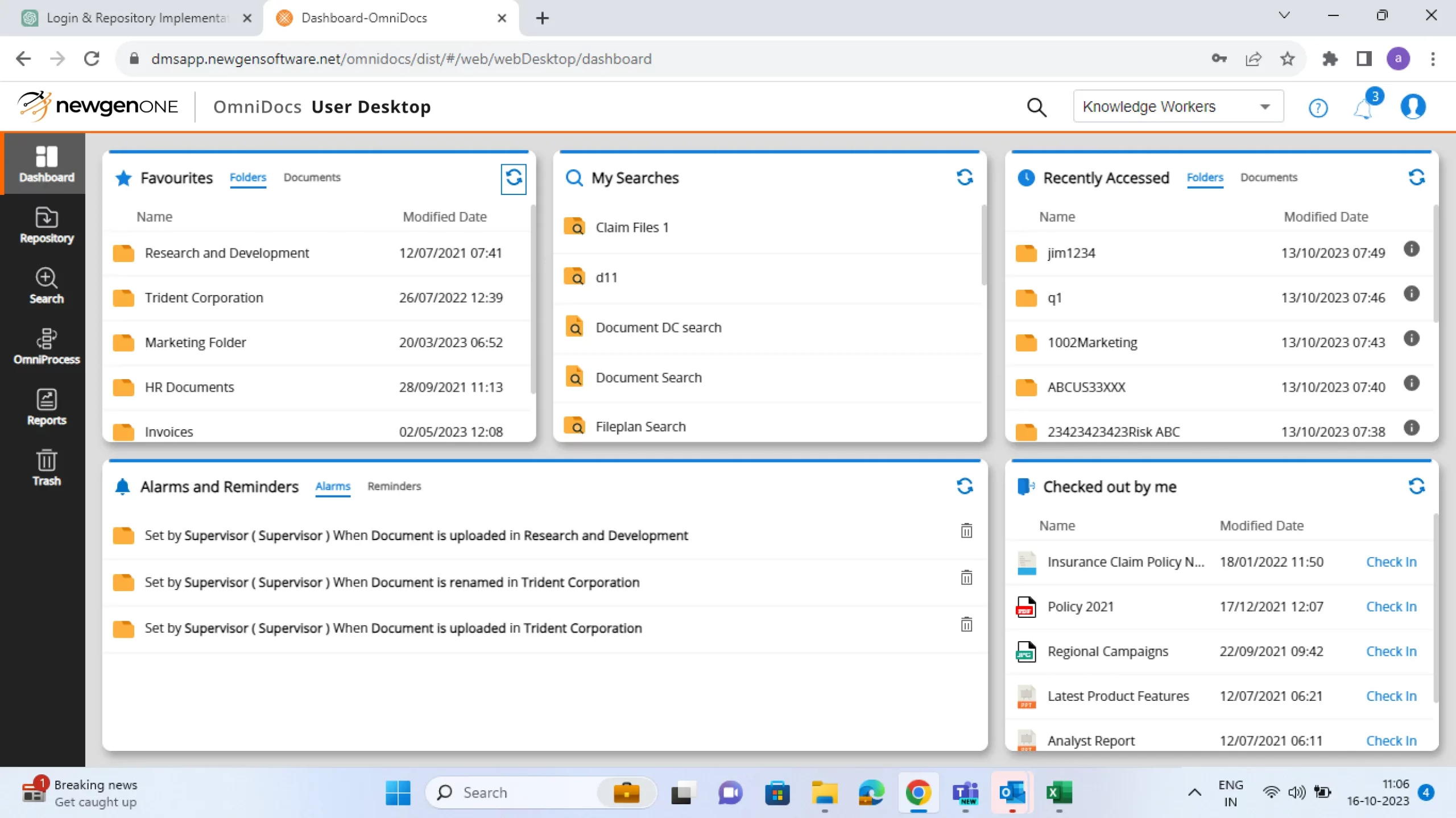

Manage content lifecycle. Ensure anytime anywhere access to content

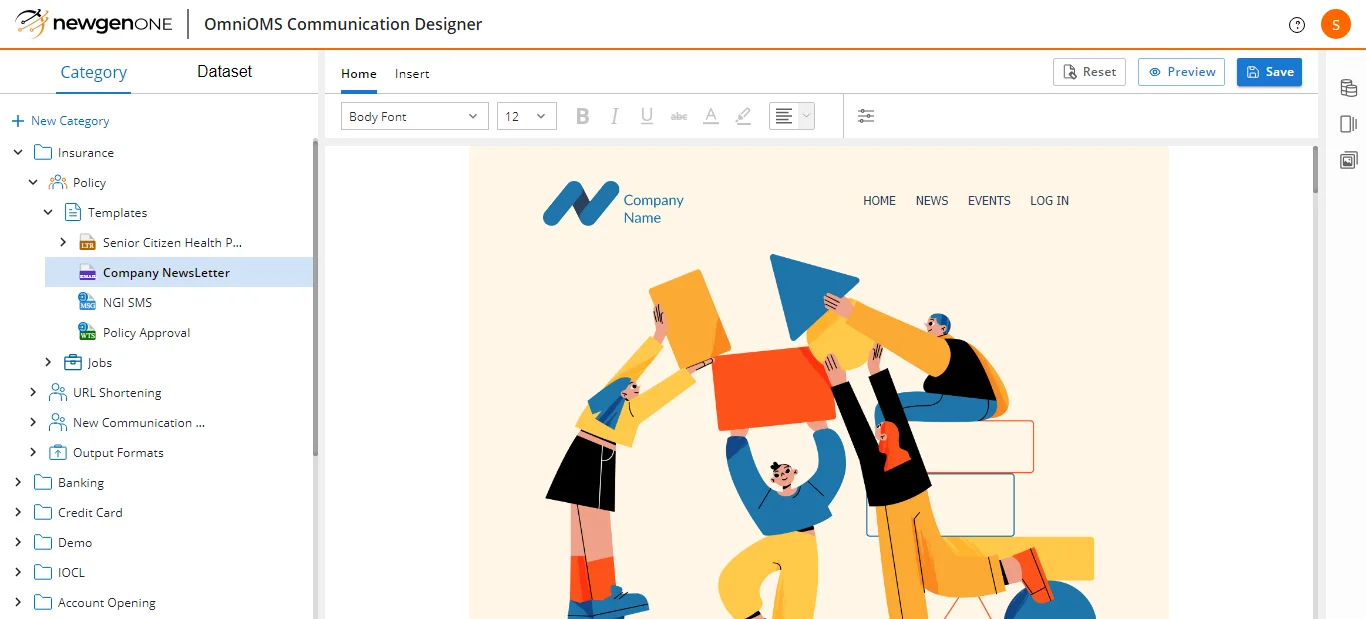

Drive real-time personalized engagement across touchpoints

Compose enterprise-grade applications at speed and scale

Make informed business decisions. Deliver transformed experience

Ready to Accelerate Digital?

See Newgen’s low-code digital transformation platform in action. Request a demo of Newgen’s platform and industry-specific applications.