Newgen is Ready!

With the finalized rule for Section 1071, Banks and Credit Unions are struggling to find the best way to handle data collection, firewalling and reporting requirements. Depending on the volumes handled by the financial institution, they would fall in Tier 1,2 or 3 and may have to start collecting the data from as early as July 18, 2025.

Newgen’s Small Business Loan Origination Solution offers Section 1071 as part of the overall lending journey or as a standalone application.

With Newgen’s advanced Small Business Loan Origination Solution, the embedded 1071 compliance feature will help financial institutions comply with regulatory changes. Newgen’s low-code platform will make adapting to any changes that may happen in Small Business Lending Rule. Meanwhile, even if your financial institution already utilizes a loan origination platform, Newgen’s solution can help fill the gaps around 1071 with quick implementation.

Newgen’s Solution for Section 1071

Reportable Loan Identification

- Application Capture

- Identifying Covered Transactions

- Validating Small Business

1071 Data Collection

- Online Data Collection

- Data Collection in Branch

- Mandatory and Optional Data Collection

- eSign Functionality

Data Firewalling

- Profile-based Demographic Data Restrictions

- Restriction for Employees Involved in Any Determination of the Covered Transaction

Reporting to CFPB

- Compliance Review Workflow

- 81+ Data Capture from Application, Existing Sources

- Export of Data into CSV Format

- Validation of the Data Export and Error Handling

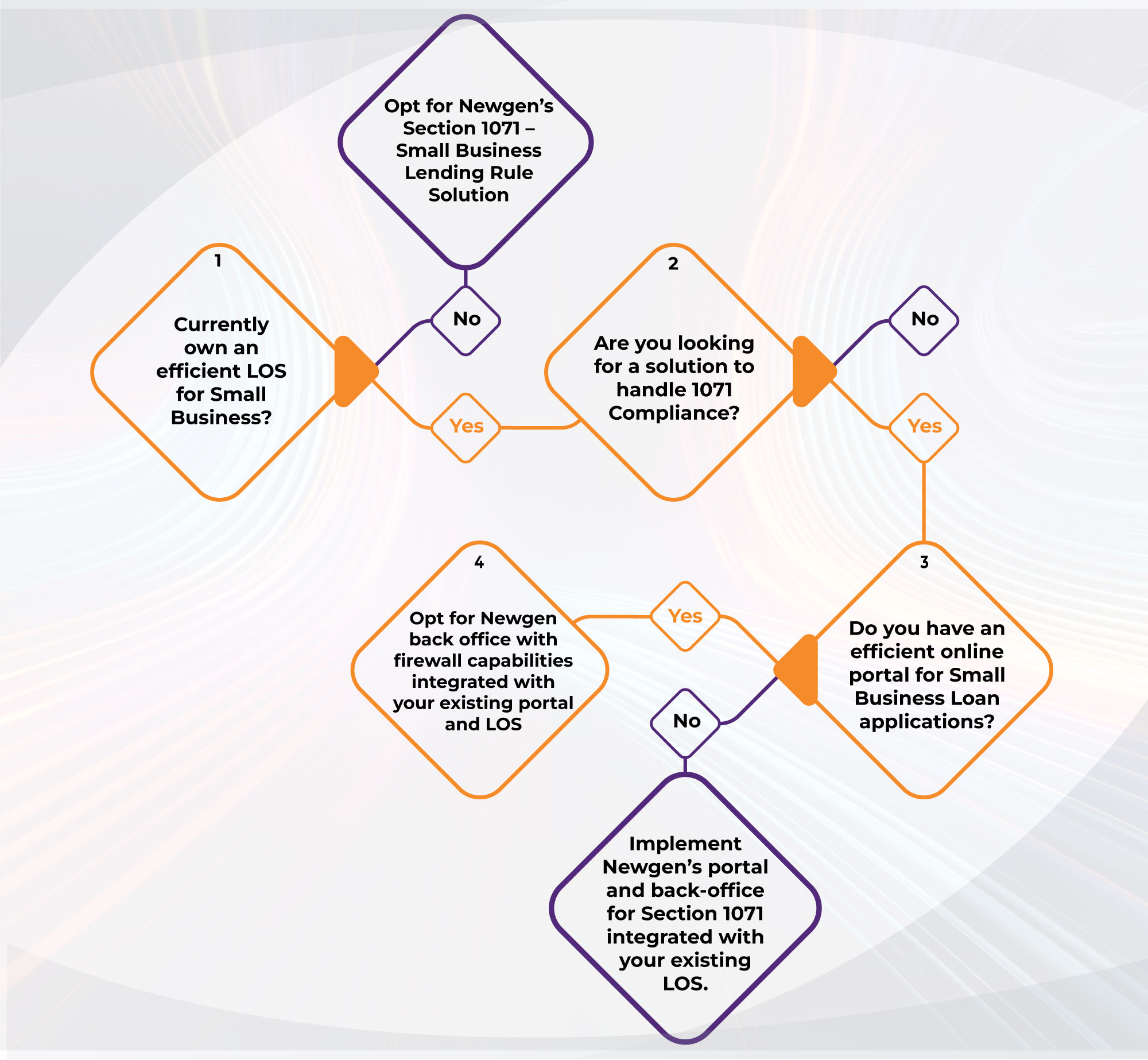

How Can Newgen Help?

Newgen can assess the existing IT landscape and operations of the FIs to suggest the best-fit approach—a full-fledged Small Business LOS, a modular 1071 solution, or a hybrid option. The FIs can access Section 1071 webinars and demonstrations showcasing the proposed approach and Newgen’s recommendations.rnrnWe also ensure peace of mind to the FIs if Section 1071 evolves further even after it has been implemented. As Newgen’s solution is built on a low-code platform, making changes to it will take days instead of weeks or months.

Newgen’s Two-Fold Approach

Comprehensive Small Business LOS Enabled with Section 1071 Functionality

Reportable loan identification will include identifying covered transactions and validating the small business. The comprehensive data capture and data security strengths will allow users to collect data from multiple sources, and effectively restrict access to data through firewalling.

Modular Architecture (à la carte) for 1071 Data with FI’s existing LOS System

In this model, Newgen provides an online portal for easy data collection, identification of covered transactions, and validation for small businesses. The data export feature makes real-time integration into the FI’s existing LOS smoother. Also, archive 1071 data in a separate system or storage as per your business needs.

Complete Data Collection

Collect the data required under Section 1071 from multiple sources including customer applications, bank entries, and third-party integrations. Find the provision for automated coding of the data in the Newgen solution and export validated data in the CFPB required file format for appropriate reporting.

Transparency and Firewall Management

Maintain a detailed audit trail of all actions for accountability and compliance for all user actions. Rights-based access ensures compliance with security for Section 1071 demographic data, restricting access for users involved in making any determination concerning a covered application.

Select Your Solution for Section 1071

Customers