AI Agents Built on NewgenONE Platform

NewgenONE AI Agents are built on a low-code platform, enabling seamless integration across the NewgenONE ecosystem. These AI agents engage with your entire business to resolve challenges across customer journeys.

Data

With the unified architecture of NewgenONE, our agents can seamlessly access consented organizational knowledge, empowering them to make well-informed, data-driven decisions

Decisions

Domain-specific fine-tuned LLMs, SLMs, and a powerful reasoning engine provide NewgenONE agents with a deep understanding of business context. Leverage the NewgenONE low-code platform to build custom models tailored to your unique business needs

Workflow

Agents, built on the NewgenONE platform, integrate natively with the low-code platform to deliver a unified solution for complex business processes

Build Intelligence Into Every Workflow

Understand how agentic AI combines autonomy with governance, transparency, and compliance for enterprise operations.

Meet NewgenONE AI Agents

NewgenONE Agentic AI Use Cases

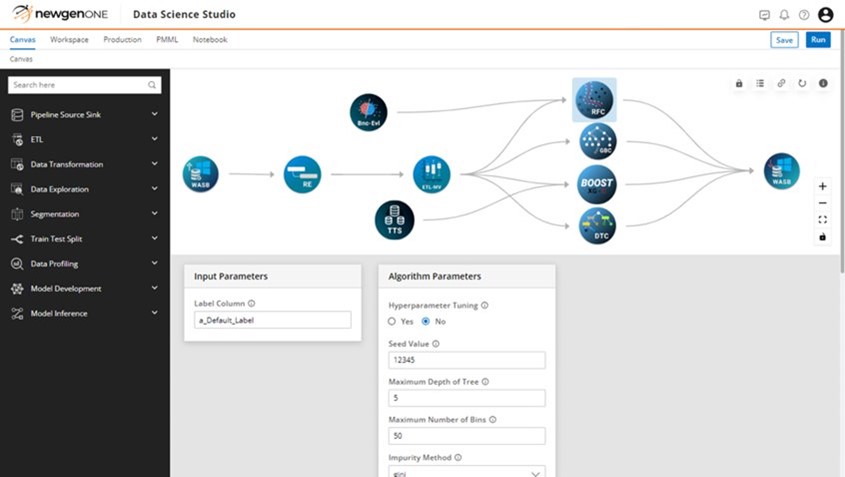

Decisions built on Low-code AI platform

Build your own AI Agent with NewgenONE Agent Studio

Data – Connect to multiple data sources

- NewgenONE ECM

- Processes built on NewgenONE

- Cloud Storage

- CSV

Cognition – Configure your agents for different use cases

Orchestration – Orchestrates multiple agents and dynamically constructs workflows, combining raw data, derived features, and predictive models

- NewgenONE Agentic Studio

Execution – Helps the user with what actions need to be taken to achieve the core business issues

Frequently Asked Questions

Agentic AI is a framework that enables the configuration, orchestration, and execution of multi-AI agents for your specific business use case in your customer journey. Agentic AI differs from traditional AI models as it requires extensive programming of particular tasks and the capability to learn and adapt dynamically. Agentic AI leverages large language models (LLMs) and short language models (SLMs) in real-time and functions based on predefined objectives to achieve desired business outcomes.

It is essential to understand that while the world may use Agentic AI and AI Agents interchangeably, the scenario is different. AI Agents are the force behind autonomously working routine tasks and orchestrating and executing by conversing with each other; Agentic AI enables this collaboration between multiple AI agents to manage end-to-end processes.

Agentic AI utilizes a multi-agent collaboration model to do non-deterministic tasks, ensuring human-like intelligence and assistance. While traditional AI models excel at pattern recognition and automation, AI agents bring intelligence closer to human cognition, making decisions autonomously in real-time.

The internet debates whether Generative AI and Agentic AI are the same, an extension, or an evolution of each other. Simply put, they differ in capabilities and value. While Generative AI focuses on content creation, insights discovery, and research suggestions, Agentic AI autonomously orchestrates and executes non-deterministic tasks aligned with organizational goals. It requires extensive training on business rule-driven cognition and LLM fine-tuning. GenAI generates creative outputs based on prompts, whereas Agentic AI enables action-oriented decision-making for complex tasks.

| Feature | Agentic AI | Generative AI |

|---|---|---|

| Purpose | Decision-making and task execution autonomously, even for non-deterministic tasks. | Content creation, insight discovery, and research reports. |

| Autonomy | High | Low |

| Application Areas | Workflow automation, end-to-end customer journey orchestrations, complex tasks, growth intelligence, hyper-personalized solutions, conversion intelligence, productivity, and scale. | Writing, designing, coding |

- Governance– Ensuring AI model ethics and governance align with organizational values.

- Transparency– Stay away from the black box and make AI decisions easy to explain to stakeholders.

- Integration– Agentic AI should seamlessly integrate with the organization’s existing workflows and systems to ensure interoperability.

Significant changes are being made in how enterprises operate now, with Agentic AI being commercialized. Enterprises will put more faith in AI agents that show reliability, data governance, security, and autonomous decision-making while handling complex tasks. This shift historically is similar to how automation and later AI-led automation were adopted in enterprises.

- Journey Orchestration- Involves designing and executing workflows for non-deterministic tasks.

- Data-driven insights- Enable superior decisions and adaptability, helping businesses stay agile in a dynamic environment.

- Tailored experiences- Agentic AI’s ability to learn and adapt ensures businesses will support meeting these expectations seamlessly.

- Driving widespread adoption- AI and GenAI tools are now mainstream, making integration easier and driving higher adoption rates.

While there have been significant developments in Agentic AI, enterprises should build a framework that supports ethical, reliable AI usage while ensuring data and coded guardrails for best usage. Isolated technological advancements will not drive the next generation of enterprise success. There must be a frictionless and strong integration of critical forces that will shape the business landscape through security and privacy, innovation, and efficiency. Below are some vital elements and why it is of utmost importance:

1. Ethical AI Guidelines

AI governance can be pivotal in ensuring fairness, transparency, and accountability in AI systems. Organizations must prioritize ethical AI use and maintain accountability throughout the AI lifecycle. Human oversight and guardrails are also important to adjust within the foundational AI behavior to make it equitable and consistently aligned with ethical and operational standards.

2. Transparency and Trust

Your AI system should leverage diverse datasets to minimize biases and ensure it delivers value by providing transparent, understandable justifications for decisions. Simplified guardrails enhance interpretability, breaking complex processes into actionable insights, fostering trust and empowering users with clear, reliable rationales.

3. Regular Monitoring and Reliability

Continuously auditing AI actions and decisions will bring confidence in every stakeholder within the Agentic AI ecosystem and continue to build regulatory confidence. Trusted AI guidelines will ensure your AI systems remain reliable, secure, and ethical. AI delivers dependable outcomes by maintaining consistent performance through oversight, accuracy metrics, and validation tests. Transparency, reinforced by robust guardrails, enables comprehensible decisions with clear rationales, empowering users and enhancing trust in Agentic AI systems.

The real power of Agentic AI remains autonomy, intelligence, and constant adaptation to solve real-world problems more efficiently than traditional systems ever could unlock growth paths at scale for enterprises in 2025 and beyond.

Agentic AI has the power to revolutionize enterprises. As it operates autonomously, companies must adopt a framework that supports self-sustaining workflows, ensures seamless data flow, and enables ongoing process optimization. Embracing this technology will drive a larger transformation within organizations, unlocking the full potential of agentic AI.

AI automation leverages artificial intelligence to streamline repetitive tasks by combining the capabilities of machine learning (ML), natural language processing (NLP), and robotic process automation (RPA). It empowers businesses to reduce labour-intensive efforts and expedite processes through efficient workflows.

From intelligent data extraction and document processing to predictive analytics and automated decisioning, AI automation transforms operations, leading to cost reduction, improved compliance, and enhanced productivity.

At Newgen, AI automation enables enterprises to drive innovation and deliver hyper-personalized customer experience amid rapidly evolving market dynamics.

AI transforms decision-making by analyzing vast datasets, identifying patterns, and generating actionable insights that drive smarter business outcomes. By leveraging machine learning (ML), predictive analytics, and natural language processing (NLP), AI enables organizations to make data-driven decisions with speed and accuracy. It minimizes human intervention, enhances efficiency, and optimizes strategies across industries.

At Newgen, AI-powered automation empowers enterprises with intelligent decisioning, real-time insights, and contextual recommendations. This enables organizations to navigate market shifts and deliver superior customer experiences.

Industries, including insurance, banking, financial services, healthcare, and government, are leveraging AI to make their tasks simpler, smarter and faster.

Banks and financial services leverage AI models such as credit decisioning engines or early warning systems to expedite loan approvals, enable fraud detection in real-time while ensuring adherence to compliance mandates, contributing to secure banking experience.

Insurance companies can leverage AI and AI Agents to automate end-to-end claims processing, policy management, and underwriting to improve accuracy, ensure early fraud detection, reduce turnaround time (TAT), and secure customers’ trust.

Healthcare providers integrate AI to improve patient data management, expedite appointment scheduling, and enable remote monitoring to enhance care delivery and minimize administrative overheads.

Government agencies utilize AI to digitize citizen services and automate workflows to make public services more accessible, efficient, and responsive. AI can enhance government productivity with AI-driven automation, ensuring regulatory compliance and fostering digital trust in modern governance.

Generative AI is advanced artificial intelligence capabilities that create new content, including text, images, music, and videos. It learns from the patterns of existing data to generate human-like responses, write articles, design graphics, or even assist with coding with prompt-based inputs.

Businesses harness Generative AI (GenAI) to streamline end-to-end automation, personalize marketing, and innovate product development. Therefore, generative AI is contributing as a key driver of digital transformation across various industries, including healthcare, finance, and entertainment, by streamlining their processes, enabling faster decision-making, and improving user experiences.

Newgen leverages Generative AI through all three AI Agents – NewgenONE Marvin, NewgenONE Harper, and NewgenONE LumYn, to enhance enterprise automation, streamline document management, improve customer engagement, improve conversions, and offer hyper-personalized solutions based on evidence-based insights.

Marvin is your go-to agent for automating routine tasks and processes. With advanced AI, Marvin streamlines operations, handles data entry, reduces errors with remarkable accuracy, and enhances overall productivity.

NewgenONE Harper is an AI agent that helps you audit 100% of your calls, highlights what your customers want, and provides you with clear steps to improve conversions. It simplifies sales and enhances customer experience for your business.

LumYn is an AI that helps financial institutions identify revenue growth opportunities by analyzing customer behavior. Its conversational AI simplifies data analysis, while a low-code environment enables fast deployment and experimentation.

AI governance is critical for enterprises to ensure responsible, transparent, and compliant AI deployment. It establishes structured policies to mitigate risks such as algorithmic bias, data privacy concerns, and regulatory non-compliance. Without governance, AI-driven decisions can lead to ethical risks, security vulnerabilities, and reputational risks.

A robust AI governance framework enhances trust, accountability, and operational control, aligning AI initiatives with business objectives and compliance requirements. It enables organizations to drive innovation while ensuring fairness, explainability, and risk management. As AI adoption is growing rapidly, enterprises with strong governance frameworks gain a strategic edge in scaling AI responsibly and sustainably.

Newgen AI governance, Agentic Shield, empowers organizations to define clear operational boundaries and limits for agent while enabling seamless configuration of business policies, engagement rules, and custom business logic. Additionally, it offers robust monitoring capabilities, allowing to track agent’s performance and ensure adherence to business standards.

AI enhances search engines with natural language processing (NLP), machine learning, and contextual understanding to deliver more relevant search results. It helps search engines understand user intent, enabling features like voice search optimization and semantic search.

AI-powered algorithms personalize search results based on user behaviour, location, and preferences, improving engagement. It also detects spam, enhances autocomplete suggestions, and refines search ranking.

AI-driven search engines continuously learn and adapt, making SEO strategies evolve. Businesses must optimize content for AI by focusing on high-quality, relevant keywords, structured data, and user experience to improve rankings.

AI workflow automation streamlines business processes by reducing manual efforts in approvals, document management, data entry, and notifications. It leverages machine learning (ML), robotic process automation (RPA), and AI-driven decision-making to improve efficiency.

AI-powered workflows integrate with CRM, ERP, and other enterprise software, ensuring seamless task execution, real-time updates, and predictive analytics. By automating repetitive tasks, businesses enhance productivity, reduce errors, and expedite operations.

AI workflow automation also supports chatbots, virtual assistants, and document processing, making it essential for business transformation, cost reduction, and optimized resource allocation across industries.

Agents, built on the NewgenONE platform, integrate natively with the low-code platform to deliver a unified solution for complex business processes. NewgenONE Marvin is the go-to agent for automating routine tasks and processes. With advanced AI, Marvin streamlines operations, handles data entry, reduces errors with remarkable accuracy, and enhances overall productivity.

AI-powered document management systems improve compliance, security, and expedites data retrieval while minimizing errors. Industries, including finance, healthcare, and government, benefit from AI-driven automated document review, contract analysis, and intelligent search capabilities to ensure faster processing, accuracy, and better decision-making.

AI-powered document management systems of Newgen transforms document processing by automating classification, extraction, validation, and data entry, significantly reducing manual intervention. Using Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning (ML), AI can identify key information, extract relevant data, and categorize documents efficiently.

AI speech recognition converts spoken language into text using Natural Language Processing (NLP) and deep learning algorithms. It powers voice assistants (Siri, Alexa, Google Assistant), automated transcription services, and hands-free applications across industries. AI-based speech recognition enhances customer service, accessibility, and user experience by enabling real-time voice commands, dictation, and multilingual support.

Businesses leverage AI speech recognition for call analytics, voice search optimization, and personalized customer interactions. With continuous learning, AI improves accuracy, understanding accents, and contextual meaning, making it essential for voice commerce, AI chatbots, Conversational AI chatbots, and interactive voice response (IVR) systems.

AI is reshaping the insurance industry through automated claims processing, fraud detection, and risk assessment. AI-powered chatbots enhance customer support, while machine learning models analyze policyholder behaviour to personalize offerings. Predictive analytics helps insurers assess risks, forecast claims, and optimize pricing.

AI-driven computer vision automates damage assessment, reducing claim settlement time. NLP enhances document processing and regulatory compliance, ensuring faster underwriting. Insurers leverage AI for sentiment analysis, customer engagement, and operational efficiency. AI enables data-driven decision-making, helping insurers improve accuracy, reduce, and ensure superior customer satisfaction.

Leverage Newgen’s AI and ML models to intelligently extract and structure critical underwriting data and eliminate manual data entry while reducing errors.

Insurers can ensure underwriting accuracy with AI-assisted risk assessment models. Our enterprise-grade Conversational AI identifies red flags, anomalies, and policy adequacy gaps by analyzing historical data, applicant profiles, and industry benchmarks, helping underwriters make informed decisions with evidence-based insights.

Enterprise AI adoption faces challenges such as data privacy concerns, integration complexity, and the need for skilled AI talent. Many organizations struggle with legacy system compatibility, data silos, and regulatory compliance when implementing AI solutions. High costs of AI infrastructure, ethical AI considerations, and bias in AI models also pose significant hurdles. Businesses need clear AI strategies, strong data governance, and robust security frameworks to ensure successful AI adoption. Overcoming employee resistance, ensuring AI transparency, and continuously refining AI models are crucial for scalability, efficiency, and enterprise-wide AI deployment success.

AI chatbots are used for customer support, virtual assistance, and automating interactions to enhance user experience. They handle inquiries, bookings, troubleshooting, and personalized recommendations across industries. AI-powered chatbots leverage Natural Language Processing (NLP) and Machine Learning (ML) to provide 24/7 customer service, reducing response times and operational costs.

Businesses use chatbots for lead generation, e-commerce assistance, and HR automation, improving efficiency. AI-driven chatbots integrate with CRM systems, social media, and websites, ensuring seamless communication. Their ability to learn from interactions, understand intent, and provide contextual responses makes them valuable for business growth and customer engagement.

Newgen’s AI-powered virtual assistants aim to provide standardized risk assessments as per policy rules and parameters, ensuring consistency in decision-making while enabling faster approvals and optimized policy recommendations.

AI enhances customer experience (CX) by personalizing interactions, automating support, and analyzing sentiment. AI-driven chatbots and virtual assistants provide instant responses and predictive assistance.

AI analyzes customer behaviour to recommend products, predict needs, and optimize engagement. Sentiment analysis helps brands understand customer emotions, enabling proactive issue resolution. AI-driven automation in CRM, email marketing, and customer service ensures seamless experiences.

By leveraging Newgen’s AI-powered solutions, businesses can reduce turnaround time (TAT), enhance self-service, and provide hyper-personalized experiences. By leveraging machine learning, NLP, and predictive analytics, AI transforms CX, enhancing satisfaction, loyalty, and brand reputation.

AI is modernizing financial services by enabling instant fraud detection, providing customer insights, and expediting loan approvals. AI-powered algorithms analyze large datasets in real-time to detect risk, prevent fraud, and ensure compliance. AI-driven chatbots and provide personalized financial guidance and investment recommendations.

Machine learning improves risk assessment, credit scoring, and loan approvals, reducing human bias. With AI-driven predictive analytics and sentiment analysis, financial institutions optimize customer engagement and decision-making. AI enhances cost-effectiveness, accuracy, and security, leading to digital transformation in banking and finance.

Newgen’s Credit Decisioning Engine helps forward-looking banks with AI-driven automation and risk models built in our business rule engine through predictive rules to provide prompt-based conversations that offer evidence-based insights to streamline the entire loan lifecycle—from pre-qualification to disbursal.

Banks can leverage multiple AI agents that offer early warning insights to detect financial stress, identify high-risk borrowers, predict defaults, and proactively mitigate portfolio risks, ensuring smarter, data-driven lending decisions.