Underwriting is very common in finance, insurance, banks, and lending business. Insurance underwriters are professionals who evaluate and analyze the risks involved in ensuring people and assets.

An insurance agent is happy to sell a policy with a high premium and consequently receives a great commission after spending considerable time on the particular customer. In some days/months, his customer claimed an unexpectedly colossal amount. Now the agent is in deep trouble, and so is the insurance company. What could have gone wrong? The customer was a high-risk individual. The insurance company should have looked at the past experiences on similar risks, carefully identified the risk, and refused to issue the policy or should have adjusted the premium and a combination of customized terms and conditions.

Insurance underwriters are involved in estimating the sum at risk, premium rates, discounts, and more, which makes the overall underwriting process extremely susceptible to even the slightest human error. Underwriters are also responsible for meeting the requirements of modern customers who want an amazon experience, even in the service industry. They want new product offerings, convenience, and simplicity. The right insurance underwriting software can help you satisfy the need of internal and external customers.

Let’s explore the capabilities required in a modern insurance underwriting software, which can help you deliver customer-centric services. Read on…

Digital underwriting requires upgraded core systems, rule-based decision making algorithms, and advanced data and business analytics. End-to-end digital transactions enable consistent and continual insights and personalized communications to customers, partners, and agents, leading to a better customer and user experience. Modern technologies that are transforming the insurance underwriting landscape include:

Big data analytics:

Growing digitalization leads to massive production of data every day. Data can be in various forms, including the form of an applicant’s identity, credit history, expenditure habits, medicinal intake, eating habits, and working and sleeping patterns. This eliminates the manual steps required to verify applicants from the insurance underwriting process. It also analyzes the risk based on their habits and helps make decisions intelligently.

Artificial Intelligence and IoT:

AI and IoT are transforming the insurance underwriting landscape. Connected devices, telematics, and sensors can help underwriters perform more accurate risk assessments in less time. It allows insurance underwriters to quickly analyze the applicant’s behavioral and financial attitudes and classify them into different risk categories. It also enables underwriters to engage customers in a meaningful way and presents customers with various attractive offers and discounts.

Machine Learning (ML):

Policy premium is calculated and perfected using comparative data of similar customer policies and past claims data. Underwriting involves analyzing this vast data to calculate a premium for policies.

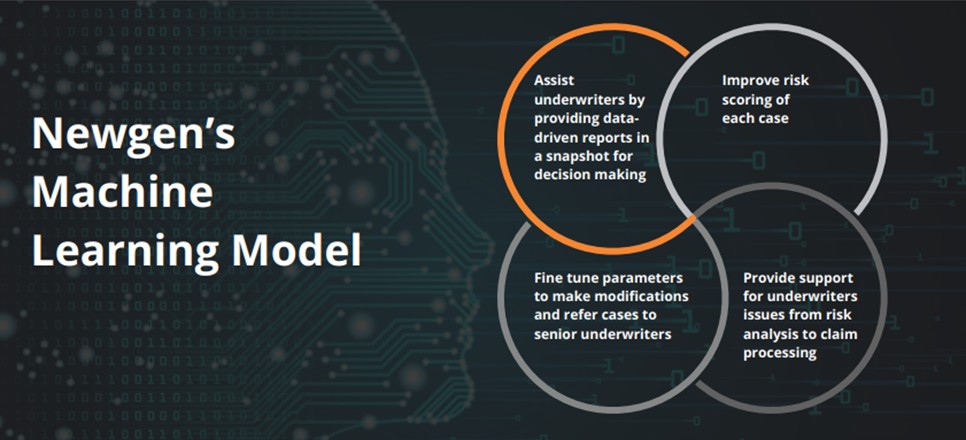

ML enables insurers to offer a personalized risk-based premium. It determines quantifiable risk factors to help keep risk scoring consistent and make insurance underwriting cost-effective and accurate. ML in insurance enables insurers to understand risk exposure, premium leakage, expense analysis, subrogation, litigation, and fraud detection. Insurers adopt ML to remain ahead of the competition and achieve operational efficiency.

In Conclusion:

Per Deloitte’s 2021 insurance outlook survey of 200 insurance executives from around the world, cited greater use of automation, alternative data, and artificial intelligence (AI) as the top three changes they need to make in the underwriting process to stay resilient through 2021 and set the stage for growth in future years.

The point to be noted is that digital underwriting does not necessarily mean eliminating human intervention, as you cannot undermine the role of talented underwriters. Insurers need to utilize the power of technology and talent equally. Good insurance underwriting software can assist your underwriters in making intelligent decisions. If the applicant meets all the given criteria, it is sent to straight-through processing. In case of any complex or critical applicants, the application is sent to the underwriters, who can make decisions based on the insights provided by intelligent underwriting software.

To know more about the automated underwriting process and how Newgen’s underwriting application can enable your organization with instant policy issuance and zero underwriting errors, click Transforming Underwriting with New-age Technologies.

You might be interested in

22 Jan, 2026

Why storing everything is not the optimal email archiving strategy for 2026