Optimize Mambu’s Core Banking Systems with Newgen’s Digital Transformation Platform

Leverage Newgen’s lending solutions, built on NewgenONE Digital Transformation Platform, along with Mambu’s core banking systems to ensure flexibility and adaptability. The integration enables financial institutions to maximize their investments in Mambu through streamlined loan application management, AI Enabled underwriting, instant disbursements on the channels, Zero-Ops for 30% cases , rule-driven decisioning & STP, workflow-based exception handling, real-time dashboards, portfolio management, advanced document management, collaboration, and more

Newgen is a certified Mambu partner! Click here to know more

Consumer Lending

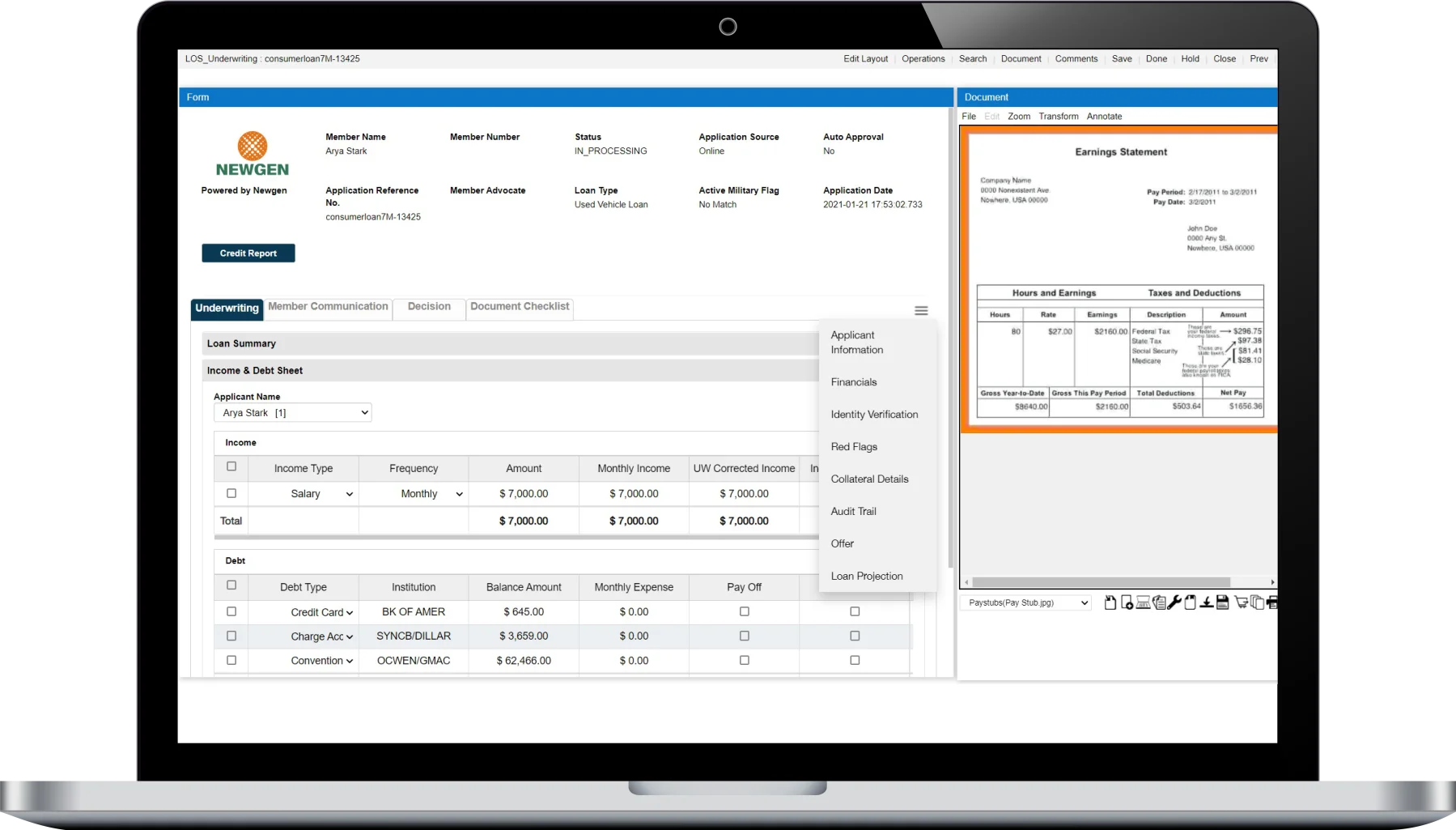

Automate end-to-end AI enabled lending journeys, from pre-screening and application processing to underwriting and disbursal across a range of products.

Enable and maximize straight through journeys with built in Rule engine and AI enabled Risk assements.

Enable seamless customer onboarding using pre-configurable templates for customer and product-specific data capture

Commercial Lending

Ensure competitive loan underwriting and effective customer engagement with contextual information

Manage the complete loan lifecycle, anytime-anywhere, by empowering the stakeholders with self-service web portals

SME Lending

Digitize a wide range of SME loan products

Gain a holistic view of all SME loan accounts by seamlessly integrating with existing systems and third-party applications

Enable simplified credit origination, approval, and monitoring, and facilitate straight-through processing of SME loan applications

Mortgage Lending

Automate the mortgage lending lifecycle, from origination and underwriting to disbursement and servicing

Allow mortgage origination, approval, and monitoring in a paperless environment through the portal with a unified view

Content Management

Manage content across Mambu core banking systems and other business applications with advanced content management capabilities

Enable document versioning, access control, intelligent content services, and advanced metadata management

Why Should You Integrate Mambu with NewgenONE Platform

Leverage flexible and agile low code platform to streamline multiple core banking processes like onboarding, loan origination, collections, and trade finance

Create, capture, classify, access, manage, distribute, and archive all external and internal documents with integrated content services for managing the entire lifecycle

Manage escalations and turnaround time by tracking, ensuring enhanced customer services

Modify credit policies with minimal IT dependence while ensuring zero downtime

Generate multilingual documents, including English and local languages

Identify and eliminate non-eligible customers at the beginning of the loan origination journey on both web and mobile app through the business rule engine

Measure KPIs and user performance in real time through configurable dashboard-based reports