Every customer application, every loan request, and every trade transaction triggers a chain of decisions. Some are simple; most are not. They involve checks, validations, risk calls, and compliance reviews that stretch across departments.

When done manually or through disjointed systems, even routine processes slow down. Errors creep in and costs rise. That’s where artificial intelligence (AI) agents step in, not as standalone tools, but as integrated partners in the banking journey itself. They smartly interpret forms, assess patterns, track actions, and expedite processes.

In this blog, let’s take a closer look at how AI agents are helping banks simplify the banking journeys. From onboarding and lending to credit checks and loan management, explore how AI-driven decisions are getting faster, smarter, and seamlessly connected.

First things First, What Are AI Agents in Banking?

AI agents are intelligent digital co-workers built to carry out specific tasks that are critical to banking operations. They review documents, validate information, check for compliance, and trigger next steps, without needing manual intervention. In banking, these agents are integrated across various functions, including:

- Customer onboarding

- Lending

- Risk assessment

- Finance operations

- Service request management

By integrating seamlessly across workflows, they enable end-to-end automation for faster, error-free processing.

To deliver a user-friendly experience, AI agents are seamlessly embedded into existing banking journeys, handling routine decisions and drastically improving turnaround time (TAT). It doesn’t stop here. By working in real time, AI agents empower banks to reduce delays, avoid errors, and streamline processes faster.

How AI Agents are Powering Core Banking Functions

Customer Onboarding

Opening a bank account isn’t a single-step task. Whether it’s done online, at a branch, or for a business, it’s far from simple. The system needs to run various steps, including identity verification, KYC, AML screening, and risk assessment. These steps often span disconnected systems, creating delays and errors.

To ease the process, many banks are turning to AI agents. They help in reviewing documents, checking records, and pushing the application forward without manual hand-offs. From accuracy perspective, AI agents learn from past records and flag inconsistencies. This means:

- In digital account opening, AI agents ensure an increased number of new accounts by auto-validating IDs and customer data in real time

- In branch account opening, AI agents support the staff by eliminating paperwork and reducing TAT from days to minutes

- In business account opening, AI agents help assess complex profiles, verify business documents, and ensure compliance across multiple parameters

There’s more to the story. Read here to find out how AI agents are enhancing customer experience.

Lending

Lending is one of the most critical areas in banking and getting it right at every stage is important. Whether it’s for a personal loan or a business credit line, from the first interaction to the final approval, each step needs to be accurate, fast, and compliant. This is where AI agents bring real value. They help banks manage the flow across systems, while checking data, validating inputs, reviewing documents, and ensuring the right steps are followed without discrepancies.

- In consumer (retail) lending, AI agents handle high-volume applications by automating checks, including income validation, credit score reviews, and eligibility filtering. Customers get faster responses, and teams focus on cases that need closer attention

- For commercial lending, the process is more layered. Applications often include financial statements, business histories, and risk exposure assessments. AI agents assist by reviewing documents, identifying red flags, and aligning information with internal credit policies, cutting down time spent on manual evaluations

By supporting both sides, personal and business, AI agents help banks deliver faster decisions without losing control over quality or compliance.

A leading Caribbean financial group transformed its customer experience, reduced operation cost by 70-80%, improved process capacity by 70-80%, and achieved TAT improvement of 75-80% with retail loan origination solution. Read here.

Trade Finance

Trade finance plays a key role in supporting cross-border and domestic transactions. There are shipments to track, invoices to verify, counterparties to assess, and compliance checks to complete, all under tight timelines. Managing the entire process manually leads to delay in verification and can hold up entire shipments or impact relationship with customers.

AI agents help reduce this friction. By reviewing trade documents, including invoices, bills of lading, and letters of credit, AI agents assist with matching data, identifying missing fields, and ensuring things move without waiting for manual approval. What once required line-by-line checks can now be reviewed efficiently, allowing teams to act faster.

The result is better control, faster processing, and fewer bottlenecks across the trade finance journey.

A Blueprint to Begin

Putting AI agents to work isn’t just about adding intelligence into one part of the process. For banks looking to move beyond fragmented workflows to more responsive, AI-enabled operations, the next step isn’t just adoption, it’s transformation. To make it work across the board, banks need a unified platform that’s built for speed, scale, and intelligence. One that doesn’t just support individual tasks but brings the entire banking journey together by seamlessly connecting people, systems, and data.

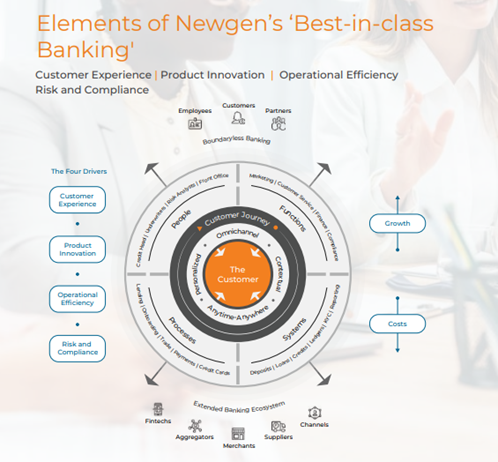

Powering AI-first Banking Journeys with Newgen

Built on AI-first low-code platform, Newgen’s digital banking solutions enables financial institutions to digitize every part of the banking journey, from onboarding and lending to compliance and servicing. The platform integrates seamlessly with existing systems, helping banks eliminate silos, improve TAT, and adhere to changing regulations. The result: connected, digital-first experiences that scale.

Complementing this is NewgenONE LumYn, a growth intelligence platform. It goes beyond operations, helps banks understand and engage customers at a deeper level. By interpreting behavior, preferences, and life stages, it helps banks deliver hyper-personalized financial journeys.

Here’s how NewgenONE LumYn empowers at every stage of the banking journey:

- Analyzes behavioral signals, financial patterns, and lifecycle needs

- Surfaces actionable insights to personalize lending, wealth, and protection offerings

- Enables teams to access insights through a conversational GenAI interface

- Moves beyond generic campaigns to deliver hyper-personalized banking journeys

- Drives cross-sell, improves conversions, and increases customer lifetime value

Together, Newgen’s AI-first low-code platform and LumYn’s intelligence layer offer a path for banks to build, deploy, and scale across both front-end experiences and back-end decisions.

For a closer look at how NewgenONE LumYn fits into your banking operations, head over here.

You might be interested in

20 Nov, 2025

Transforming Enterprises with Newgen’s Business Process Management Software