Why Newgen’s Digital Customer Onboarding Platform?

60% Reduction in Abandonment Rates

Reduce abandonment rates and maximize deposit growth.

40% Faster Onboarding

Speed up customer onboarding with efficient digital workflows.

80% Automation

Automate KYC, AML, and other key processes to reduce manual work.

100% Compliance

Ensure compliance with all regulatory requirements seamlessly.

Risk Management

Advanced fraud detection and real-time monitoring to minimize risks.

Seamless Integration

Easily integrate with existing systems for a smooth onboarding experience.

20% Higher Customer Satisfaction

Offer an intuitive and engaging onboarding journey.

99.9% Security

Top-tier data protection and platform reliability.

Newgen empowers top U.S. banks with a secure, efficient, AI-first, customer-focused digital onboarding platform.

Unique Features of Newgen Digital Customer Onboarding Solution

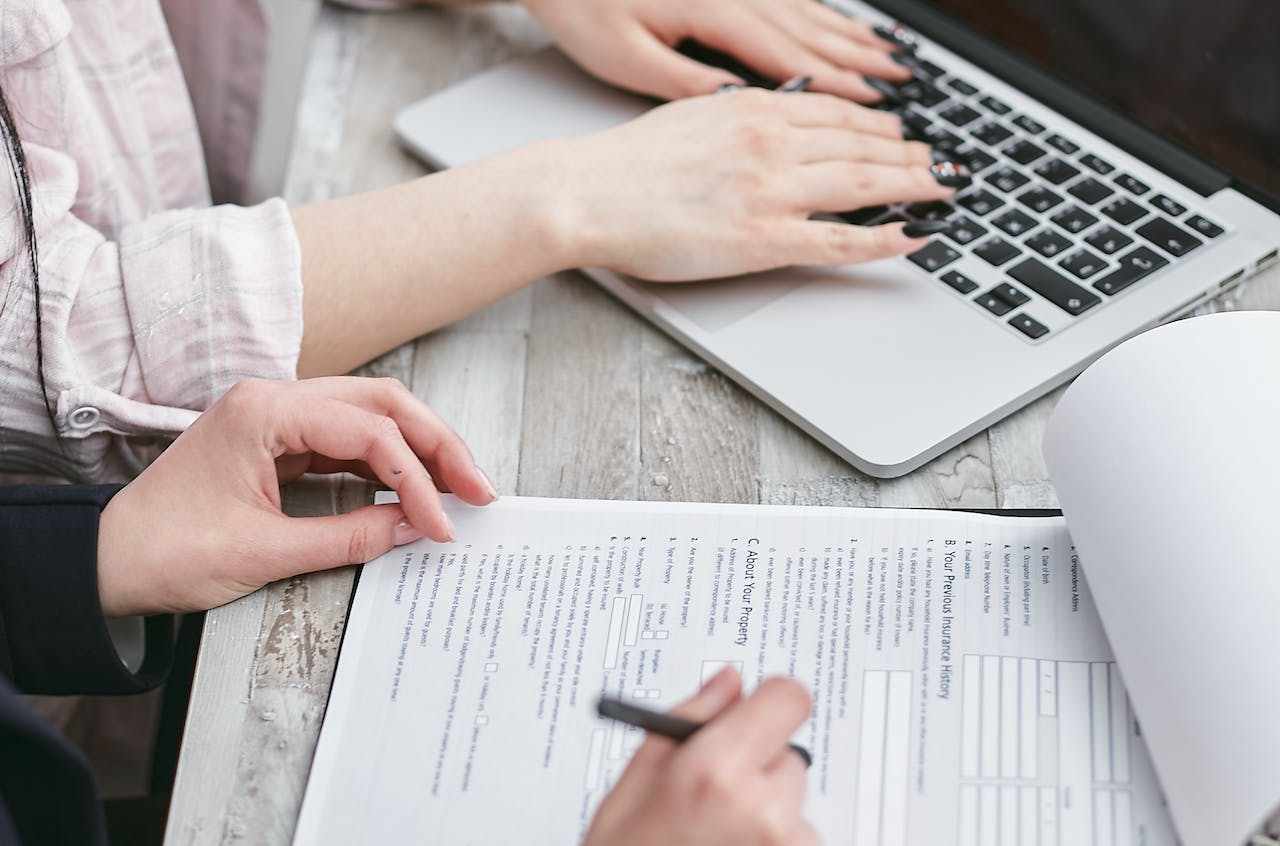

Online and in-branch journey

Support for deposit and loan account opening

Support for consumer and business account opening

Account maintenance automation

Support for complex products such as IRA, HSA, Trust Accounts, etc.

“Newgen’s digital onboarding solution reduced our onboarding time by 40% and boosted customer satisfaction significantly. Its automation and seamless integration have been game-changers for us.”

Chief Digital Officer, Leading U.S. Customer